Insights

The Role of Alternative Investments in Portfolio Diversification

Investing is an essential aspect of personal finance that requires careful consideration and planning. Diversification is a fundamental principle of investing, which involves spreading your investments across various asset classes, Read More »

Alternative Investment Funds: Opportunities and Challenges

In earlier blogs, we saw Alternative investment funds (AIFs) becoming increasingly popular among investors seeking higher returns, diversification, and exposure to non-traditional assets. However, AIFs also pose several challenges, such Read More »

Alternative Investment Funds: An In-Depth Guide to Private Equity, Venture Capital, and Hedge Funds

Alternative Investment Funds (AIFs) as seen here refer to investment vehicles that invest in assets beyond traditional stocks, bonds, and cash. Private Equity (PE), Venture Capital (VC), and Hedge Funds Read More »

Alternative Investment Funds: A Comprehensive Guide for Investors

Alternative investment funds (AIFs) have gained a lot of popularity among investors in recent years due to their potential to provide higher returns compared to traditional investment options. AIFs provide Read More »

Important terms for Quantitative Trading Success

Quantitative trading is a method of using mathematical models and algorithms to analyze financial data and make predictions about the market. It is a highly technical field, and understanding key Read More »

Role of Technology in Active Quantitative Investing

Quantitative investment strategies use advanced technology and mathematical models to analyze large amounts of financial data and make investment decisions. This approach has become increasingly popular in recent years due Read More »

Benefits and Challenges of Quantitative Investing

In our previous note, we looked at Active Quantitative Investing and understood that it is a strategy that uses mathematical models and algorithms to analyze financial data and make investment decisions. Read More »

Active Quantitative Investing

Active quantitative investing (AQI) is an investment strategy that combines the use of quantitative analysis with active management. It involves using systematic models and algorithms to make investment decisions, while Read More »

Trend Following Strategies

Introduction Trend following is one of the alternative investment strategies that has potential to perform in both rising and falling markets, including crises. These strategies utilize a systematic approach where Read More »

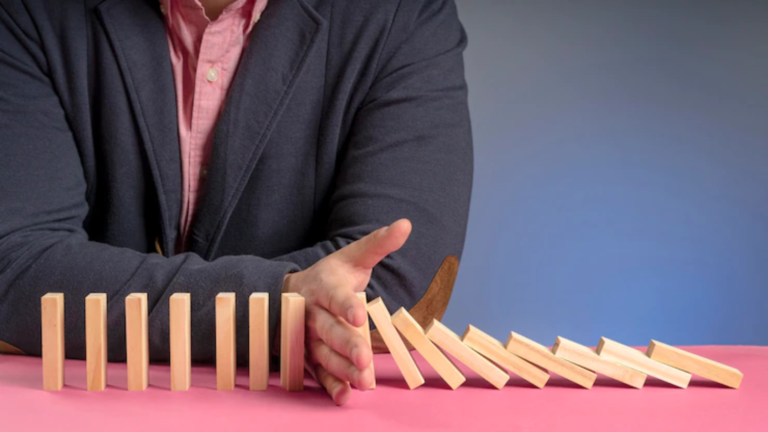

Risk Mitigation

Given that we know what kinds of portfolio risks to be aware of and a way to quantify them here, we will proceed to the final piece of the risk Read More »

How To Measure And Quantify Risk?

Now that we have looked at various kinds of risk here and here, the question arises as to how we can measure or quantify some of them so as to Read More »

Lesser-Known Portfolio Risks

We looked at some well-known portfolio risks in our previous note Portfolio Risk, we shall now look at a few of the lesser-known risks and explore what kind of products Read More »