Introduction

Trend following is one of the alternative investment strategies that has potential to perform in both rising and falling markets, including crises. These strategies utilize a systematic approach where models seek to identify trends in market, with an assumption that the trend will continue (upward moving markets will continue to rally and downward moving markets will continue to decline). The strategies typically trade liquid, exchange listed futures and tend to run a diversified portfolio across asset classes.

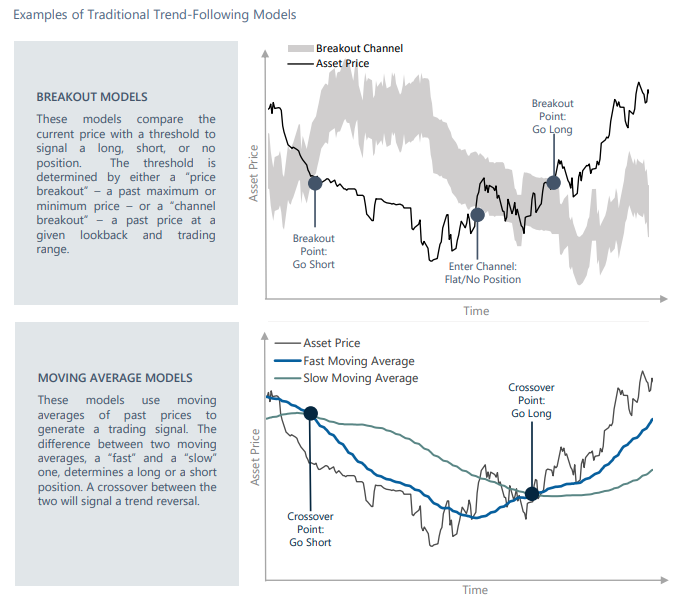

A classic trend following strategy will determine its signal based on price and volume data, its position sizing based on market volatility and manages risk by defining strict exit conditions. Breakout or moving average cross-over strategies are common examples.

Source: Graham Capital Management

Why do markets trend?

The performance of trend following strategies depend on existence of trends which can exist in time of crisis or uncertainty and even “normal” market conditions. The rationale for existence of market trends include:

Confirmation Bias: Recent price performance is more often seen as representation of future performance and investors act accordingly.

Risk Management: Due to highly leveraged futures trading, markets are susceptible to short covering and long liquidation after a “quick” market move.

Regime Change/Effect Lag: Some forces take time to fully act and exhibit their behavior such as policy changes or capex investments.

Risk Premia: Participants may be willing to pay higher for a high P/E ratio stock sending prices higher or may pay higher for a “trending” investment (crypto, meme, ESG, FOMO etc)

Key characteristics

Trend following strategies are usually scalable, transparent, rule-based and typically liquid in nature. These could perform across market cycles and have no inherent bias to the overall market, hence a positive absolute return strategy over a long term.

They have low correlation with traditional investments and a small allocation can typically reduce portfolio volatility and reduce overall market beta, improve overall risk adjusted performance. In addition, they can potentially reduce sharp portfolio drawdowns.

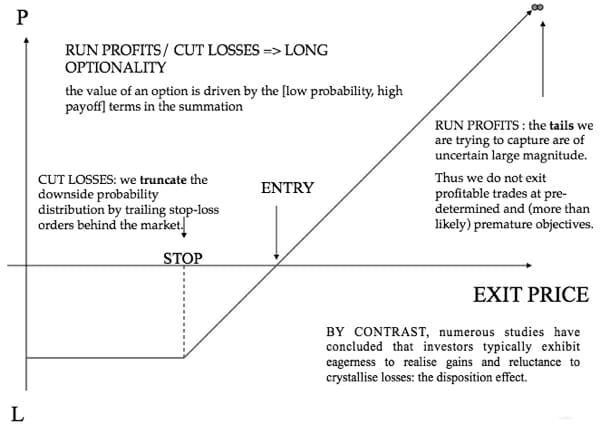

These strategies also provide positive portfolio convexity, which can be visualized as nonlinear high absolute returns delivered by these strategies in a crisis environment when beta performance will suffer.

Source: Mulvaney Capital

In conclusion, trend following strategies are a useful portfolio addition to mitigate tail risk scenarios based on historical performance, however they should not be used as a pure tail hedge as the positive performance in such conditions is not guaranteed.